秒词邦

分题型分考点背单词 文

文 文

文

李嘉诚家族卷进内地的一些房地产资产处置风波中。

根据京东拍卖消息,上海长润江和房地产发展有限公司(以下简称“长润江和”)40%股权于7月9日首次拍卖,起拍价约53.49亿元,2人报名,但因无人出价最终流拍。

长润江和成立于2007年10月,是长实集团与和润集团为开发位于上海普陀真如城市副中心项目“高·尚领域”而成立的项目公司,二者分别持股60%、40%。由于和润集团旗下公司上海长润房地产开发有限公司(以下简称“上海长润”)、上海江和房地产开发有限公司(以下简称“上海江和”)破产清算,其所持长润江和40%股权被债权人中融国际信托有限公司申请处置。

高·尚领域项目地块为2006年年底长实集团与和润集团以底价22亿元联合竞得的上海普陀真如A3、A4、A5、A6地块,总建筑面积约117万平方米,业态涵盖写字楼、商场、酒店、公寓、住宅等,其中,300米的超高层写字楼落成后是上海浦西的地标性建筑。

李嘉诚家族曾对这个项目寄予厚望。

长实集团在2007年1月公布的交易公告中称,收购、拥有及发展普陀地块为商业及住宅物业,乃符合长实及和黄其中一项核心业务策略。2009年4月,时任长实集团董事总经理兼副主席暨和黄副主席的李泽钜出席了高·尚领域的开工仪式并表示,“我们对有机会领衔打造上海真如城市副中心感到非常兴奋,决心在区域内创造一个和谐社区。”

18年过去,真如城市副中心繁华兑现,而高·尚领域仍未完全落成,项目公司股权也因合作方的债务危机被摆上拍卖台。

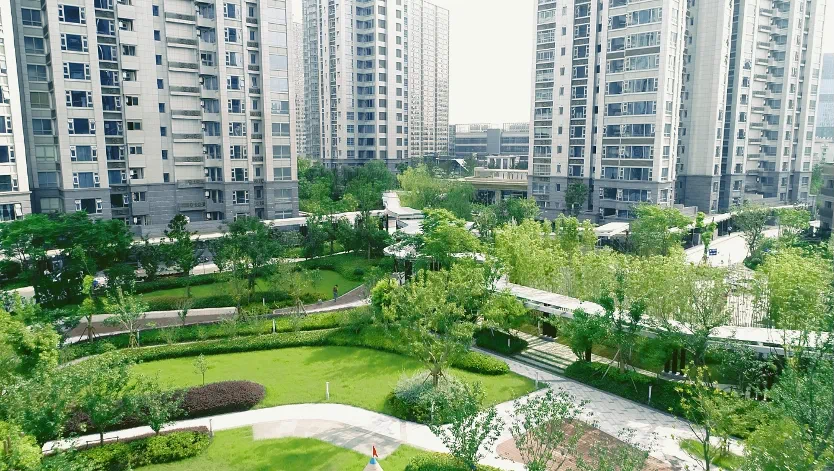

高·尚领域,图源:项目微信公众号

这并非李嘉诚家族近期首次因涉及资产出售而受到关注。

7月11日,“李嘉诚家族5折卖房”冲上热搜。事件指向李嘉诚家族旗下长实集团位于东莞的海逸豪庭项目在清盘阶段,推出了部分团购优惠单位。据销售人员介绍,特价房源均是天地楼层或楼层较矮,价格在每平方米1.3万元至1.5万元左右,此前该项目销售均价约2.3万元至2.4万元。

万人围观无人出价

高·尚领域股权被拍卖,源于和润集团的债务危机。

公开信息显示,和润集团是国内领先的粮油加工企业,在粮油产业占据相当的市场份额,在浙江舟山、湖北武汉、四川泸州等城市拥有生产基地。

和润集团法定代表人虞松波曾被称为“舟山首富”,如今已债务缠身。根据天眼查,截至7月11日,虞松波关联的限制消费令记录232条、失信被执行人记录5条、被执行人记录7条,被执行总金额约22亿元。

上海市第三中级人民法院出具的民事裁定书显示,上海长润、上海江和因为资不抵债,具备破产原因,因此二者持有的长润江和40%股权被拍卖偿债。

根据拍卖公告,长润江和主要包含两项资产——存货,即高·尚领域的土地出让金、前期工程费、建安工程费等开发成本,账面值约76.36亿元;固定资产,即高·尚领域的房地产,包括商业、办公、会所、酒店及车位等,账面原值约36.38亿元。

7月9日,长润江和40%股权正式开拍,起拍价约53.49亿元,一共吸引1.2万次围观,2人报名,但最终因无人出价而流拍。

长润江和40%股权流拍,有多重原因。

上海易居研究院研究总监严跃进向时代周报记者表示,真如城市副中心略显边缘,商办物业非常仰赖区位优势,“综合体项目能不能做起来,与所在区域的购买力、客流量密切相关。”

另一方面,53.49亿元的起拍价,在当下对于大多数投资者而言都是一笔巨大的负担,严跃进说,“真如项目总价比较高,现在能拿得出50多亿元的机构很少。”

严跃进进一步表示,目前上海的土地市场,二三十亿元就能拍到非常优质的地块,比如保利发展近日竞得的杨浦平凉社区02H1-01地块,地价约22亿元,“核心区域的住宅项目质量好,回款快,而商办物业本来就过剩了,商圈自身规划对项目运营而言也有压力,投资者肯定是算过账的。”

不止外部缺陷,长润江和自身也存在不少瑕疵。

根据《上海长润江和房地产发展有限公司资产评估报告》,长润江和由雅富投资有限公司(“长实系”公司)、上海长润、上海江和分别按60%、25%、15%的比例出资成立。截至2023年11月30日,长润江和注册资本尚未完成实缴,三大股东的实缴金额分别为17.31亿元、5.71亿元、3.43亿元,实缴比例62.25%。

此外,根据拍卖公告,由于高·尚领域已售物业尚未进行土地增值税清算,且项目地块实际经济指标与土地出让合同约定经济指标存在差异,加上项目延期竣工,如拍卖成交,竞买人需承担土地增值税、土地出让金以及逾期竣工违约金等费用。

“高·尚领域这种大型综合体项目的转让比较困难,只能进一步压低出售价格,单纯一家机构或普通的联合体资金压力会比较大,很难消化。”严跃进表示。

长实进退

现实过于骨感。作为优先购买权人,即便高·尚领域是长实集团入沪的首个大型综合体项目,即便长实集团曾有意全资持有高·尚领域项目,他们也在拍卖台前克制住了自己。

2006年12月底,上海普陀真如城市副中心第一幅巨量地块A3-A6地块出让。没有遇到任何对手,长实集团联合和润集团以22亿元竞标底价摘得地块,折合楼面价约3027元/平方米。

长实集团官网显示,真如项目总建筑面积逾117万平方米,是目前上海最大规模城市综合发展项目之一,结集商场、办公室、住宅、服务式住宅及酒店物业。《东方早报》报道称,整个项目的投资将在60亿元左右,而这一项目也将被建设成普陀地区的一个地标性建筑。

2009年4月,真如A3-A6地块正式动工,标志着上海第四个城市副中心的启动建设。

由于地价低廉,开发周期漫长,迎上房价上涨周期,长实集团在真如项目收益颇丰。

2013年6月,长实集团真如项目以“高·尚领域”的案名正式亮相,推出首期产品,售价约3.5万元/平方米,部分特色单位高达4.5万元/平方米。两个月后,高·尚领域首开单位宣告售罄,收金约26亿元。

2019年6月,高·尚领域首次推出住宅产品“领寓”,包括1108套房源。据观点网,长实集团次年公布的2019年销售成绩显示,领寓开盘半年销售金额达73亿元,位列上海住宅总销售套数及金额排名前三。

直至今年3月,高·尚领域仍有73套住宅推出,均价约10万元/平方米。7月11日,时代周报记者从高·尚领域销售人员处了解到,目前项目仅剩少量底复(一楼带地下室)在售,“(股权拍卖事件)对我们没什么影响,有影响我们会收到消息的。”

领寓,图源:项目微信公众号

拿地至今的漫长18年里,关于高·尚领域的权益归属传言多次传出。

2019年5月,有市场消息称长实集团有计划出售高·尚领域项目权益。对此长实集团回应称,公司经常有收到不同的出价建议,但有建议不代表公司接受及会出售项目。

2020年1月,风向转变,港媒报道称长实集团有意增加内地投资份额,收购和润集团所持的高·尚领域股份,最终全资持有该项目。长实集团方面表示,公司有兴趣作出研究,且事实上公司有优先购买权。

彼时,楼市热钱汹涌,市场交投活跃。上海中原地产统计数据显示,2019年上海新建商品住宅共成交773.5万平方米,同比上涨19.46%,处于近3年高位。但长实集团这一收购意愿最终并未落地。

4年后,长实集团又一次拿到“优先购买权人”的号码牌,故事仍未迎来完满结局,长润江和40%股权首拍流拍。长实集团上海公司市场传讯部一名工作人员向时代周报记者表示:“这是公司高层的决定,没有更多消息可以透露。”

针对为何放弃竞买股权、高·尚领域逾期竣工原因等问题,时代周报记者于7月11日致函长实集团方面,截至发稿未收到回复。

Li Ka shing's family's mainland assets are embroiled in controversy: 50% off promotion for Dongguan property, failed equity auction for Shanghai Putuo landmark

Die Zeit

July 13, 2024 18:41:50 from Guangdong

1 person participated in 1 comment

The Li Ka shing family is embroiled in some real estate asset disposal controversies in mainland China.

According to JD Auction, 40% equity of Shanghai Changrun Jianghe Real Estate Development Co., Ltd. (hereinafter referred to as "Changrun Jianghe") was auctioned for the first time on July 9th, with a starting price of approximately 5.349 billion yuan. Two people registered, but it ultimately failed due to no bidders.

Changrun Jianghe was established in October 2007 as a project company by Changshi Group and Herun Group for the development of the "High fashion Field" project located in the sub center of Zhenru City, Putuo, Shanghai. The two companies hold 60% and 40% of the shares, respectively. Due to the bankruptcy liquidation of Shanghai Changrun Real Estate Development Co., Ltd. (hereinafter referred to as "Shanghai Changrun") and Shanghai Jianghe Real Estate Development Co., Ltd. (hereinafter referred to as "Shanghai Jianghe"), the 40% equity of Changrun Jianghe held by them has been applied for disposal by creditor Zhongrong International Trust Co., Ltd.

The Gaoshang Field project site is the A3, A4, A5, and A6 plots of Shanghai Putuo Zhenru jointly won by Changshi Group and Herun Group at a bottom price of 2.2 billion yuan at the end of 2006. The total construction area is about 1.17 million square meters, and the business formats include office buildings, shopping malls, hotels, apartments, residences, etc. Among them, the 300 meter super high-rise office building will be a landmark building in Puxi, Shanghai after completion.

The Li Ka shing family had high hopes for this project.

In the transaction announcement released by Cheung Kong Holdings in January 2007, it was stated that the acquisition, ownership, and development of the Putuo plot as a commercial and residential property was in line with one of the core business strategies of Cheung Kong Holdings and Hutchison Whampoa. In April 2009, Li Zeju, then the Managing director and Vice Chairman of Changshi Group and Vice Chairman of He Huang, attended the groundbreaking ceremony of Gao Shang Field and said, "We are very excited about the opportunity to lead the construction of Shanghai Zhenru City Sub Center and are determined to create a harmonious community in the region

18 years have passed, and the bustling sub center of Zhenru City has been realized, while the Gao Shang area has not yet been fully completed, and the equity of the project company has also been put up for auction due to the debt crisis of the partner.

Gao Shangtian, source: project WeChat official account

Gao Shangtian, source: project WeChat official account

This is not the first time that the Li Ka shing family has received attention recently due to asset sales.

On July 11th, "Li Ka shing family sells house at 50% off" went viral on the hot search list. The incident points to the liquidation stage of the Haiyi Haoting project in Dongguan, owned by the Li Ka shing family's Cheung Kong Group, which has launched some group buying discount units. according to the salesperson, the discounted properties are all on the Tian Di floor or on shorter floors, with prices ranging from 13000 to 15000 yuan per square meter. Previously, the average sales price of this project was about 23000 to 24000 yuan.

Thousands of people are watching, but no one is bidding

Gao Shang's equity in the field was auctioned off due to the debt crisis of Herun Group.

Public information shows that Herun Group is a leading grain and oil processing enterprise in China, occupying a considerable market share in the grain and oil industry. It has production bases in cities such as Zhoushan in Zhejiang, Wuhan in Hubei, and Luzhou in Sichuan.

Yu Songbo, the legal representative of Herun Group, was once known as the "richest man in Zhoushan" and is now heavily in debt. According to Tianyancha, as of July 11th, there were 232 records of restricted consumption orders, 5 records of dishonest persons subject to enforcement, and 7 records of persons subject to enforcement related to Yu Songbo, with a total amount of approximately 2.2 billion yuan.

The civil ruling issued by the Third Intermediate People's court of Shanghai shows that Shanghai Changrun and Shanghai Jianghe have bankruptcy reasons due to insolvency, and therefore their 40% equity in Changrun Jianghe was auctioned off to repay debts.

According to the auction announcement, Changrun River mainly consists of two assets - inventory, which includes development costs such as land transfer fees, preliminary engineering fees, and construction and installation fees for Gaoshang Field, with a book value of approximately 7.636 billion yuan; Fixed assets, including commercial, office, clubhouse, hotel, and parking spaces in the high-end real estate sector, have an original book value of approximately 3.638 billion yuan.

On July 9th, Changrun River and 40% equity officially started filming, with a starting price of about 5.349 billion yuan, attracting a total of 12000 spectators. Two people signed up, but it ultimately failed due to no bids.

There are multiple reasons for the failed auction of 40% equity of Changrun River.

Yan Yuejin, the research director of Shanghai E-house Research Institute, told Time Weekly reporters that the sub center of Zhenru City is slightly on the edge, and commercial property management relies heavily on location advantages. "Whether a comprehensive project can be developed is closely related to the purchasing power and passenger flow of the area

On the other hand, the starting price of 5.349 billion yuan is a huge burden for most investors at present. Yan Yuejin said, "The total price of the Zhenru project is relatively high, and there are very few institutions that can offer more than 5 billion yuan now

Yan Yuejin further stated that in the current land market in Shanghai, it is possible to obtain very high-quality land plots for two to three billion yuan. For example, Poly Development recently won the bid for the Yangpu Pingliang Community 02H1-01 plot, with a land price of about 2.2 billion yuan. "The residential projects in the core area have good quality and fast payment collection, but there is already an excess of commercial properties. The planning of the commercial district itself also puts pressure on project operation, and investors must have calculated it

Not only external defects, but also Changrun River and itself have many flaws.

According to the Asset Appraisal Report of Shanghai Changrun Jianghe Real Estate Development Co., Ltd., Changrun Jianghe was established with contributions from Yafu Investment Co., Ltd. ("Changshi Group"), Shanghai Changrun, and Shanghai Jianghe at a ratio of 60%, 25%, and 15%, respectively. As of November 30, 2023, the registered capital of Changrun Jianghe has not been fully paid in. The actual paid in amounts of the three major shareholders are 1.731 billion yuan, 571 million yuan, and 343 million yuan, respectively, with a paid in ratio of 62.25%.

In addition, according to the auction announcement, due to the fact that the properties sold in Gao Shang area have not yet undergone land value-added tax settlement, and there are differences between the actual economic indicators of the project site and the economic indicators stipulated in the land transfer contract, coupled with the delayed completion of the project, if the auction is successful, the bidder shall bear the costs of land value-added tax, land transfer fee, and overdue completion penalty.

The transfer of large-scale integrated projects such as Gaoshang Field is relatively difficult, and can only further lower the selling price. A single institution or ordinary consortium will face significant financial pressure, which is difficult to digest, "Yan Yuejin said.

Long term advancement and retreat

Reality is too rigid. As a pre emptive right holder, even though Gaoshang Field is Changshi Group's first large-scale integrated project in Shanghai, and even though Changshi Group had intended to fully hold Gaoshang Field projects, they restrained themselves in front of the auction table.

At the end of December 2006, the first large-scale plot of land A3-A6 in Shanghai Putuo Zhenru City Sub center was sold. Without encountering any opponents, Changshi Group and Herun Group won the land with a bid price of 2.2 billion yuan, equivalent to a floor price of about 3027 yuan/square meter.

According to the official website of Changshi Group, the total construction area of the Zhenru project exceeds 1.17 million square meters, making it one of the largest urban comprehensive development projects in Shanghai, integrating shopping malls, offices, residences, serviced apartments, and hotel properties. The Oriental Morning Post reported that the investment for the entire project will be around 6 billion yuan, and this project will also be built into a landmark building in the Putuo area.

In April 2009, the Zhenru A3-A6 plot officially started construction, marking the start of the construction of Shanghai's fourth urban sub center.

Due to the low land price and long development cycle, as well as the rise in housing prices, Changshi Group has benefited greatly from the Zhenru project.

In June 2013, the Zhenru project of Changshi Group was officially unveiled under the name of "High Fashion Field", launching the first phase of products with a price of about 35000 yuan/square meter, and some featured units reaching up to 45000 yuan/square meter. Two months later, Gao Shang's first unit in the field was announced to be sold out, with a revenue of approximately 2.6 billion yuan.

In June 2019, Gao Shang launched its first residential product, "Lingyu," which includes 1108 units. According to Viewpoint Network, the 2019 sales results released by Changshi Group the following year showed that the sales amount of Lingyu in the first half of the year reached 7.3 billion yuan, ranking among the top three in terms of total sales of residential units and amount in Shanghai.

As of March this year, there were still 73 residential units launched in the Gao Shang area, with an average price of about 100000 yuan/square meter. On July 11th, a reporter from Time Weekly learned from sales personnel in the Gao Shang field that there are only a small number of bottom ups (with basement on the first floor) for sale in the project. "The equity auction event has little impact on us, but if it does, we will receive news

Lingyu, source: project WeChat official account

Lingyu, source: project WeChat official account

In the long 18 years since the acquisition of the land, rumors about the ownership of rights in the Gao Shang field have been circulating multiple times.

In May 2019, there were market reports that Changshi Group had plans to sell its equity in the Gao Shang field project. In response to this, Changshi Group stated that the company often receives different bidding suggestions, but having suggestions does not mean that the company accepts or will sell the project.

In January 2020, the wind direction changed, and Hong Kong media reported that Cheung Kong Holdings Limited intended to increase its investment share in mainland China by acquiring the shares of Gao Shang Field held by Harmony Group, and ultimately fully holding the project. Changshi Group stated that the company is interested in conducting research and in fact has the right of first refusal.

At that time, there was a surge of hot money in the real estate market and active market trading. According to statistics from Shanghai Zhongyuan Real Estate, a total of 7.735 million square meters of newly-built residential properties were sold in Shanghai in 2019, a year-on-year increase of 19.46%, reaching a high in nearly three years. However, the acquisition intention of Changshi Group ultimately did not materialize.

Four years later, Changshi Group once again obtained the number plate of "pre emptive right holder", but the story has not yet reached a satisfactory ending, and the first auction of Changrun River and 40% equity failed. A staff member from the Market Communication department of Changshi Group Shanghai Company told Time Weekly reporters, "This is a decision made by the company's senior management, and there is no further information to disclose

On July 11th, a reporter from Time Weekly wrote to Changshi Group regarding the reasons for giving up bidding for equity and the reasons for the delayed completion of Gaoshang Field. As of the time of publication, no response has been received.

句子成分分析:(划分说明![]() ) 提示:框中标识可点击

) 提示:框中标识可点击

[According to statistics (from Shanghai Zhongyuan Real Estate)], a total (of7.735 million square meters (of newly-built residential properties)) were sold [inShanghai] [in 2019], a year-on-year increase (of 19.46%), reaching a high [innearly three years].

句子语法结构详解:

(sold 为 sell 的过去分词。)

* sold 为谓语,采用一般过去时和被动语态。

* reaching 为现在分词,作状语。

* were 为助动词。a 为不定冠词。

句子相关词汇解释:

Phrase:

| according to | 根据,据(某人)所述 |

| real estate | 房地产;不动产 |

| square meter | 平方米 |

Vocabulary:

| statistics [stә'tistiks] | n. | 统计学, 统计资料 |

| Shanghai | n. | [中国省市] 上海 |

| total ['tәutl] | n. | 总数,总额,合计,总计 |

| residential [,rezi'denʃәl] | a. | 1) (城市中的地区)适合居住的,住宅的 2) (工作、课程等)需要在某地居住的,提供住宿的 |

| property ['prɔpәti] | n. | 1) 所有物,财产,财物 2) 不动产,房地产 |

| sell [sel] | vt. | 1) 出售,售卖 2) 促(销),推(销) |

| increase ['iŋkriːs] | n. | 增长,增多,增加 |

| reach [ri:tʃ] | vt. | 1) 达到,提升到,进入(新水平/阶段) 2) 到达, 抵达(某地,某点位) |

| high [hai] | n. | 1) 最高水平 2) 反气旋,高气压区 |

| nearly ['niәli] | ad. | 几乎; 差不多 |

| three [θri:] | num | 三 |

| year [jiә] | n. | 1) 年 2) 一年时间 |

句子成分分析:(划分说明![]() ) 提示:框中标识可点击

) 提示:框中标识可点击

[Four years later], Changshi Group [once again] obtained the number plate (of"pre emptive right holder"), || but the story has not [yet] reached a satisfactoryending, || and the first auction (of Changrun River and 40% equity) failed.

句子语法结构详解:

* obtained 为谓语,采用一般过去时。

* but 为并列连词,连接并列句,表转折。

* reached 为谓语,采用现在完成时。

* 第1个 and 为并列连词,连接并列句。

* failed 为谓语,采用一般过去时。

* has 为助动词。the 为定冠词。a 为不定冠词。

句子相关词汇解释:

Phrase:

| once again | 再次 |

| number plate | (车辆的)牌照;号码牌 |

| not yet | 还没 |

Vocabulary:

| four [fɔ:] | num | 四 |

| year [jiә] | n. | 1) 年 2) 一年时间 |

| later ['leɪtə] | ad. | 1) 后来, 以后, 稍后, 迟些时候 2) late 的比较级 |

| group [gru:p] | n. | 1) 组,团体,群,批 2) [商]集团 |

| obtain [әb'tein] | vt. | (尤指经努力)获得,赢得 |

| right [rait] | n. | 1) 正当的要求,权利 2) 正当,公正,正义,正确 |

| holder ['hәuldә] | n. | 1) 持有者,拥有者 2) 支托(或握持)……之物 |

| but [bʌt] | conj. | 1) 但是 2) 而, 却 |

| story ['stɔ:ri] | n. | 1) (虚构的)故事,小说等 2) (真实情况或对往事的)口述,叙述、新闻报道 3) [美](=storey)楼层 |

| reach [ri:tʃ] | vt. | 1) 达到,提升到,进入(新水平/阶段) 2) 到达, 抵达(某地,某点位) |

| satisfactory [,sætis'fæktәri] | a. | 令人满意的,够好的,可以的 |

| ending ['endiŋ] | n. | 1) (故事等的)结局 2) 结束 |

| first [fә:st] | a. | 1) 第一的 2) 最初的; 最先的 |

| auction ['ɔ:kʃәn] | n. | 拍卖 |

| river ['rivә] | n. | 1) 河,江 2) (液体)涌流 |

| and [ænd] | conj. | 1) 和, 与, 同, 并 2) 然后,接着 |

| equity ['ekwiti] | n. | 1) (公司的)股本,资产净值 2) (equities)(公司的)普通股 |

| fail [feil] | vi. | 1) 失败 2) (考试或评定等) 不及格 |

以上是秒词邦为您整理编写的文章《李嘉诚家族内地资产被卷进风波:东莞楼盘5折促销,上海普陀地标股权流拍》的全部内容。秒词邦是国内权威分题型分考点背诵中高考/四六级考研/专升本/出国单词的专业单词软件。扫描如下小程序码,进入秒词邦官方小程序获取更多英语相关资料! 【关键词:高考单词;高考英语;高中单词;高中英语;单词app;单词软件;记单词app;记单词软件;背单词软件;背单词app;英语单词;四六级单词;四六级英语;四六级单词app;四六级单词软件;考研单词app;考研单词软件;核心单词;高考冲刺复习;高考英语教材;高考英语真题;四六级真题;四六级试题;考研真题;考研英语单词;考研英语真题】