秒词邦

分题型分考点背单词 文

文 文

文

7月初,又有两座万达广场被卖了。据公开资料,自2023年至今已有27家相关公司被转让。

在今年4月,北京万达总部大楼也被卖了。什么信号?

退出!又卖了

7月1日,烟台芝罘万达广场有限公司发生工商变更,原全资股东大连万达商业管理集团股份有限公司退出。新增股东包括坤华股权投资合伙企业与坤元辰兴投资管理咨询有限公司,分别持有约99.99%和0.01%的股份。此次变更同时涉及多位主要人员。

此前,烟台芝罘万达广场有限公司的注册资本已由5000万人民币增至7.08亿人民币。2014年11月21日,烟台芝罘万达广场开业,成为万达商管旗下第103座万达广场。

万达商管官网显示,自转型商业中心建设运营以来,万达集团建设运营万达广场从第1座到第100座用了15年,从第100座到第300座用了5年。

7月2日,宜春万达广场投资有限公司也在近日发生多项工商变更,原全资股东大连万达商业管理集团股份有限公司退出。

多个万达广场发生股权变更引发市场关注。据统计,烟台芝罘万达成为万达自2023年至今转让的第27家公司。此前,万达已转让旗下多地万达广场关联公司的股权。

今年以来,上海金山万达广场、广州萝岗万达广场、湖州万达广场、太仓万达广场等多个万达广场股权在去年完成变更。还有厦门殿前万达广场、呼和浩特万达广场、海口万达广场、福州白湖亭万达广场、合肥万达广场等接连发生工商变更。

北京万达总部大楼也被卖

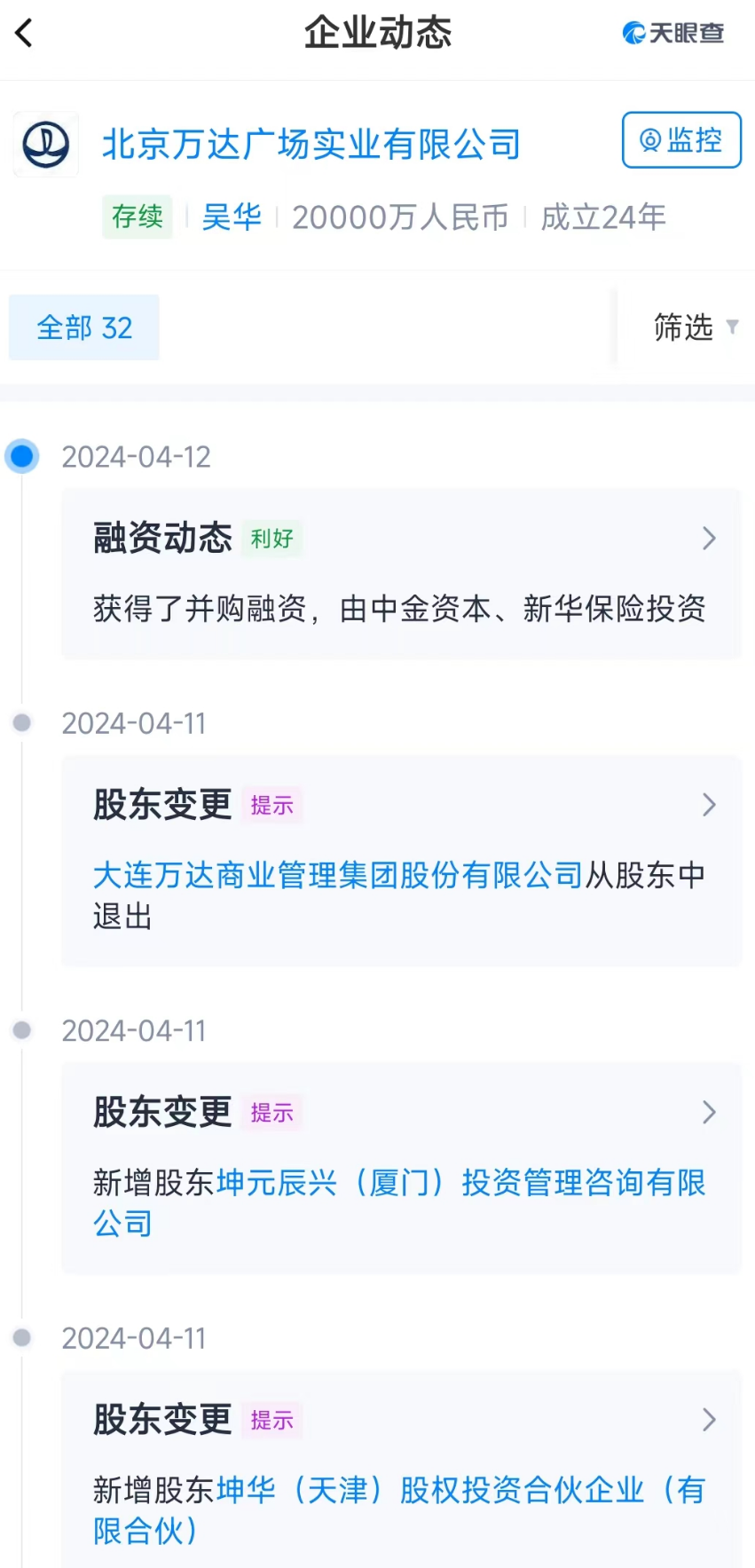

据天眼查,今年4月万达集团总部所在地,位于北京大望路的北京万达广场也被出售。

海报新闻视频截图

2019年,王健林曾表示万达商业是万达的核心,什么企业都可以放,唯独万达商业不能放。

谁在接盘?

万达开启“卖卖卖”模式,接盘的是谁?据不完全统计,万达出售的资产,多数引入保险公司作为新的股东,包括新华保险、阳光保险、大家保险等。

就比如此次接手烟台芝罘万达广场的是新华保险、中金资本。

股权穿透图显示,坤华(天津)股权投资合伙企业(有限合伙)由新华保险、中金资本运营有限公司分别持股99.99%、0.01%,坤元辰兴(厦门)投资管理咨询有限公司2位自然人股东也在中金相关公司任职。

此前,坤华投资、坤元辰兴一同受让了北京万达广场实业有限公司,受到外界关注。

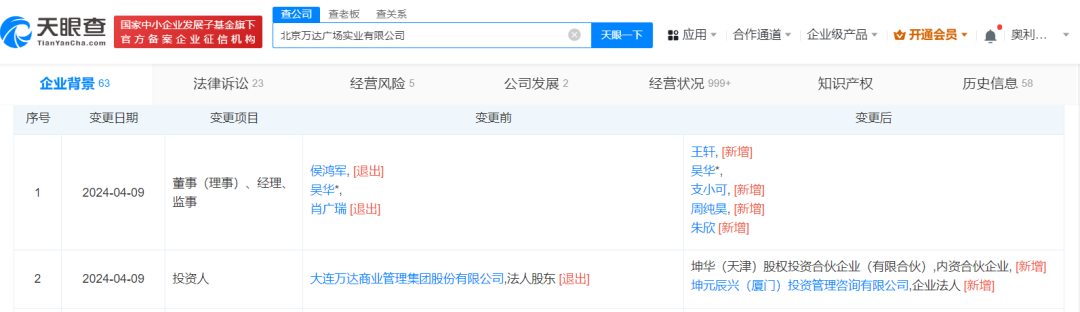

天眼查显示,2024年4月9日,北京万达的全资股东万达商管退出,新增股东坤华投资、坤元辰兴。

在5月底接盘了合肥万达广场的苏州联商壹号,其间接控股股东为丽水联融壹号股权投资合伙企业(有限合伙),最终控股股东系阳光人寿,后者系阳光保险的控股子公司。

去年12月,苏州联商壹号还相继接盘了位于太仓、湖州、上海、广州的多家万达广场。

公开资料显示,去年5月底,大家保险将万达旗下上海松江万达广场、西宁海湖万达广场和江门台山万达广场三个购物中心间接收入囊中;10月份,又拿下了上海周浦万达广场。

卖卖卖或将持续

万达的“卖卖卖”似乎并没有停止,资产出售或将持续。除了上述万达广场,万达还将旗下电影、酒店业务摆上了货架。

2023年12月26日,万达集团出售上海万达瑞华酒店资产。此前,万达电影也发生了重大股权变更,腾讯旗下的上海儒意投资管理有限公司实现对北京万达投资有限公司的全资控股,成为万达电影的第一大股东。

万达为何持续“卖卖卖”?这与其资金链紧张不无关系。

据21世纪经济报道此前报道,2023年11月10日,珠海万达商管第五次更新招股书,更新了部分财务数据。

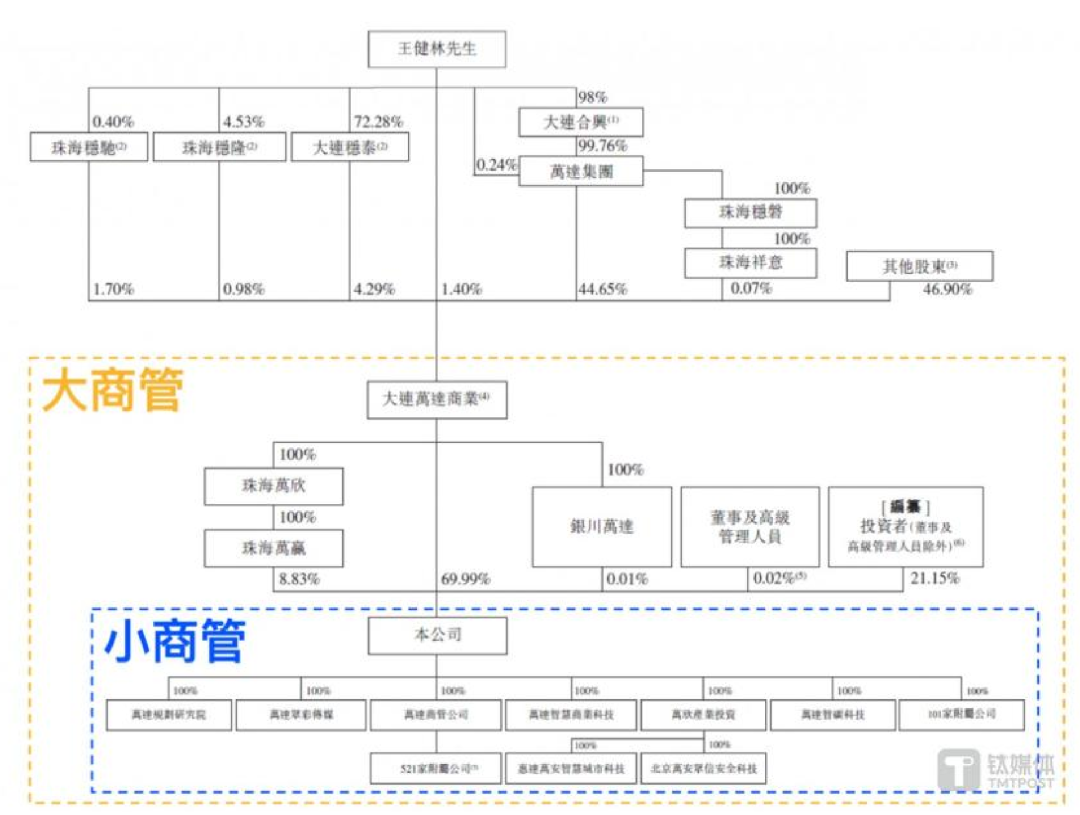

图片来源:珠海万达商管招股书

根据招股书,2020年至2022年,珠海万达商管的收入分别为人民币171.95亿元、234.81亿元及271.18亿元;净利润分别为11.12亿万元、35.12亿元及75.33亿元。

2023年12月28日,据港交所披露的信息,珠海万达商业管理集团股份有限公司的招股书再度失效。由于冲击港股IPO迟迟未能成功,为缓解对赌压力,万达选择出售其在全国范围内的部分资产以换取流动资金。

获600亿输血后,162亿元股权被冻结

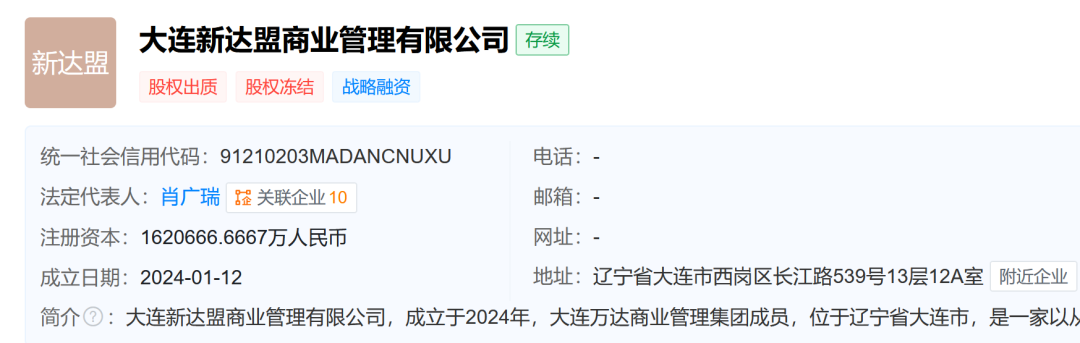

据21世纪经济报道记者此前消息,2024年3月底,大连万达商管与太盟投资集团、阿布扎比投资局、穆巴达拉投资公司、中信资本、ARES等投资方正式签约,资方联合向大连新达盟投资约600亿元。

不过,天眼查显示,6月28日,大连万达商管所持有的大连新达盟(大连新达盟商业管理有限公司)162亿元全部股权再次被冻结。冻结期限至2027年6月27日,执行法院为广东省珠海市中级人民法院。

除了大连新达盟以外,大连万达商管所持的大连万耀企业管理有限公司、大连万智企业管理有限公司、大连万跃企业管理有限公司股权也被冻结。

王健林父子重回富豪榜前十

上个月,王健林、王思聪父子以1408亿元的总身家,重回富豪榜前十,一度引发广泛关注。

据新财富500创富榜最新榜单,王健林、王思聪父子由于拥有大连万达商管集团46%股权,以1408亿元资产重回前十。

数据来源:新财富

2023年,王健林陆续出让了万达电影、珠海万达商管的控制权以回笼现金。目前,其仍掌握着大连万达商管集团46%的股权,后者2023年正常发债,按3000亿元净资产测算,加上持有的万达电影股份,王健林父子总身家达1408亿元,重新跻身创富榜第九名,2023年排在第25位。

虽然王健林父子重回富豪榜,但万达系并未能完全度过危机。

What signal is there when Wang Jianlin transfers his assets again?

Wang Jianlin transferred his assets again!

In early July, two more Wanda Plaza were sold. according to public information, 27 related companies have been transferred since 2023.

In April of this year, the headquarters building of Beijing Wanda was also sold. What signal?

sign out! Sold again

On July 1st, Yantai Zhifu Wanda Plaza Co., Ltd. underwent a business change, and the original wholly-owned shareholder Dalian Wanda Commercial management Group Co., Ltd. withdrew. The newly added shareholders include Kunhua Equity Investment Partnership and Kunyuan Chenxing Investment Management Consulting Co., Ltd., which hold approximately 99.99% and 0.01% of the shares, respectively. This change involves multiple key personnel simultaneously.

Previously, the registered capital of Yantai Zhifu Wanda Plaza Co., Ltd. had increased from 50 million RMB to 708 million RMB. On November 21, 2014, Yantai Zhifu Wanda Plaza opened, becoming the 103rd Wanda Plaza under Wanda Commercial Management.

According to the official website of Wanda Business Management, since the construction and operation of the self transforming commercial center, Wanda Group has taken 15 years to construct and operate Wanda Plaza from the 1st to the 100th, and 5 years from the 100th to the 300th.

On July 2nd, Yichun Wanda Plaza Investment Co., Ltd. also underwent multiple business changes recently, with the former wholly-owned shareholder Dalian Wanda Commercial Management Group Co., Ltd. withdrawing.

Multiple Wanda Plaza equity changes have attracted market attention. According to statistics, Yantai Zhifu Wanda has become the 27th company transferred by Wanda since 2023. Previously, Wanda had transferred equity in multiple affiliated companies of Wanda Plaza under its umbrella.

Since the beginning of this year, the equity of several Wanda Plaza companies, including Shanghai Jinshan Wanda Plaza, Guangzhou Luogang Wanda Plaza, Huzhou Wanda Plaza, and Taicang Wanda Plaza, has been changed last year. There have been consecutive industrial and commercial changes in Xiamen Dianqian Wanda Plaza, Hohhot Wanda Plaza, Haikou Wanda Plaza, Fuzhou Baihuting Wanda Plaza, Hefei Wanda Plaza, and others.

The Beijing Wanda headquarters building has also been sold

According to Tianyancha, Beijing Wanda Plaza, located on Dawang Road in Beijing, where Wanda Group's headquarters is located, was also sold in April this year.

Screenshot of poster news video

In 2019, Wang Jianlin once stated that Wanda Commercial is the core of Wanda, and any enterprise can be released, but Wanda Commercial cannot be released.

Who is taking the tray?

Wanda has launched a "sell sell sell" model, who is taking over the order? According to incomplete statistics, most of the assets sold by Wanda have introduced insurance companies as new shareholders, including Xinhua Insurance, Sunshine Insurance, and Everyone Insurance.

Just like this, it was Xinhua Insurance and CICC Capital that took over Yantai Zhifu Wanda Plaza.

The equity penetration chart shows that Kunhua (Tianjin) Equity Investment Partnership Enterprise (Limited Partnership) is held by Xinhua Insurance and CICC Capital Operations Co., Ltd. with 99.99% and 0.01% respectively. Two natural person shareholders of Kunyuan Chenxing (Xiamen) Investment Management Consulting Co., Ltd. also hold positions in CICC related companies.

Previously, Kunhua Investment and Kunyuan Chenxing jointly acquired Beijing Wanda Plaza Industrial Co., Ltd., which received external attention.

According to Tianyancha, on April 9, 2024, Wanda Commercial Management, a wholly-owned shareholder of Beijing Wanda, withdrew and added new shareholders Kunhua Investment and Kunyuan Chenxing.

At the end of May, it acquired Suzhou Lianshang No.1 at Wanda Plaza in Hefei. Its indirect controlling shareholder is Lishui Lianrong No.1 Equity Investment Partnership (Limited Partnership), and the ultimate controlling shareholder is Sunshine Life Insurance, which is a subsidiary of Sunshine Insurance.

Last December, Suzhou Lianshang No.1 also successively took over multiple Wanda Plaza located in Taicang, Huzhou, Shanghai, and Guangzhou.

According to publicly available information, at the end of May last year, Dajia Insurance indirectly acquired three shopping centers under Wanda, namely Shanghai Songjiang Wanda Plaza, Xining Haihu Wanda Plaza, and Jiangmen Taishan Wanda Plaza; In October, they also won Shanghai Zhoupu Wanda Plaza.

Selling or Will Continue

Wanda's "selling and selling" seems to have not stopped, and asset sales may continue. In addition to the above-mentioned Wanda Plaza, Wanda has also put its film and hotel businesses on the shelves.

On December 26, 2023, Wanda Group sold the assets of Shanghai Wanda Ruihua Hotel. Previously, Wanda Film also underwent a significant equity change, with Tencent's Shanghai Ruyi Investment Management Co., Ltd. achieving a wholly-owned controlling stake in Beijing Wanda Investment Co., Ltd., becoming the largest shareholder of Wanda Film.

Why does Wanda continue to sell? This is not unrelated to the tension in its funding chain.

According to a previous report by 21st Century Business Herald, on November 10, 2023, Zhuhai Wanda Commercial Management updated its prospectus for the fifth time, updating some financial data.

Image source: Zhuhai Wanda Commercial Management's prospectus

According to the prospectus, from 2020 to 2022, the revenue of Zhuhai Wanda Commercial Management was RMB 17.195 billion, RMB 23.481 billion, and RMB 27.118 billion, respectively; The net profits were 1.112 billion yuan, 3.512 billion yuan, and 7.533 billion yuan, respectively.

On December 28, 2023, according to information disclosed by the Hong Kong Stock Exchange, the prospectus of Zhuhai Wanda Commercial Management Group Co., Ltd. was once again invalidated. due to the unsuccessful IPO of the Hong Kong stock market, Wanda has chosen to sell some of its assets nationwide in exchange for working capital to alleviate the pressure of gambling.

After receiving 60 billion yuan in blood transfusions, 16.2 billion yuan in equity was frozen

According to previous reports from 21st Century Business Herald reporters, at the end of March 2024, Dalian Wanda Commercial Management officially signed a contract with investors such as Taimeng Investment Group, Abu Dhabi Investment Bureau, Mubadala Investment Company, CITIC Capital, ARES, etc. The investors jointly invested about 60 billion yuan in Dalian Xindameng.

However, according to Tianyancha, on June 28th, all equity of 16.2 billion yuan held by Dalian Wanda Commercial Management Co., Ltd. in Dalian Xindameng (Dalian Xindameng Commercial Management Co., Ltd.) was once again frozen. The freezing period is until June 27, 2027, and the executing court is the Intermediate People's Court of Zhuhai City, Guangdong Province.

In addition to Dalian Xinda Alliance, the equity of Dalian Wanyao Enterprise Management Co., Ltd., Dalian Wanzhi Enterprise Management Co., Ltd., and Dalian Wanyue Enterprise Management Co., Ltd. held by Dalian Wanda Commercial Management has also been frozen.

Wang Jianlin and his son return to the top ten on the billionaire list

Last month, the father and son of Wang Jianlin and Wang Sicong returned to the top ten of the rich list with a total wealth of 140.8 billion yuan, which attracted widespread attention.

According to the latest list of the New Fortune 500 Wealth Creation List, Wang Jianlin and Wang Sicong, father and son, have returned to the top ten with 140.8 billion yuan in assets due to their 46% stake in Dalian Wanda Commercial Management Group.

Data source: New Wealth

In 2023, Wang Jianlin gradually transferred control of Wanda Film and Zhuhai Wanda Commercial Management to recover cash. At present, it still holds 46% of the equity of Dalian Wanda Commercial Management Group. The latter will issue bonds normally in 2023, with a net asset of 300 billion yuan, and the total wealth of Wang Jianlin and his son reached 140.8 billion yuan, ranking ninth on the wealth creation list and 25th in 2023.

Although Wang Jianlin and his son have returned to the rich list, the Wanda family has not fully overcome the crisis.

句子成分分析:(划分说明![]() ) 提示:框中标识可点击

) 提示:框中标识可点击

[Last month], the father and son (of Wang Jianlin and Wang Sicong) returned tothe top ten (of the rich list) [with a total wealth (of 140.8 billion yuan, (whichattracted widespread attention))].

句子语法结构详解:

* returned 为谓语,采用一般过去时。

* which 为关系代词,引导非限制性定语从句。

* attracted 为谓语,采用一般过去时。

* the 为定冠词。a 为不定冠词。

句子相关词汇解释:

Phrase:

| last month | 上个月 |

| return to... | 1) 回到..., 返回到... 2) 恢复到... |

| the top ten | (某星期)流行音乐十大畅销唱片 |

Vocabulary:

| father ['fɑ:ðә] | n. | 1) 父亲 2) 祖先 |

| and [ænd] | conj. | 1) 和, 与, 同, 并 2) 然后,接着 |

| son [sʌn] | n. | 1) 儿子 2) 孩子 |

| rich [ri:tʃ] | a. | 1) 富裕的, 富有的 2) 大量含有的 |

| list [list] | n. | 1) 名单,目录,清单 2) (船)倾斜 |

| total ['tәutl] | a. | 1) 总的,总计的,全体的,全部的 2) 完全的,彻底的,包括一切的 |

| wealth [welθ] | n. | 1) 财富,财产 2) 富裕,富足 |

| yuan [ju:'ɑ:n] | n. | 元(中国货币单位) |

| attract [ә'trækt] | vt. | 1) 吸引,使喜爱,引起……的好感(或爱慕) 2) 招引 |

| widespread ['waidspred] | a. | 分布广的,普遍的,广泛的 |

| attention [ә'tenʃәn] | n. | 1) 注意,专心,留心 2) 兴趣,关注 |

句子成分分析:(划分说明![]() ) 提示:框中标识可点击

) 提示:框中标识可点击

[At present], it still holds 46% (of the equity (of Dalian Wanda CommercialManagement Group)).

The latter will issue bonds [normally] [in 2023], [with a net asset (of 300 billion yuan)], || and the total wealth (of Wang Jianlin and his son) reached 140.8 billion yuan, ranking ninth [on the wealth creation list and 25th] [in 2023].

句子语法结构详解:

* holds 为谓语,采用一般现在时。动词采用第三人称单数形式。

* issue 为谓语,采用一般将来时。

* 第1个 and 为并列连词,连接并列句。

* reached 为谓语,采用一般过去时。

* ranking 为现在分词,作状语。

* will 为情态动词。his 为形容词型物主代词。the 为定冠词。a 为不定冠词。

相关语法知识:

时态

时态

动词的第三人称单数形式

动词的第三人称单数形式

并列连词

并列连词

现在分词

现在分词

情态动词 | 物主代词

情态动词 | 物主代词

句子相关词汇解释:

Phrase:

| at present | 目前, 现在 |

| the latter | (刚提及的两者中的)后者;(系列中)最后一位,末位 |

Vocabulary:

| still [stil] | ad. | 1) 仍然, 还是,还 2) (加强比较级)还要,还有,更 |

| hold [hәuld] | vt. | 1) 拿着,抓住,抱住,托住,夹着,捂住, 按住 2) 使保持(在某位置), 固定住 |

| equity ['ekwiti] | n. | 1) (公司的)股本,资产净值 2) (equities)(公司的)普通股 |

| Dalian | n. | [中国省市] 大连 |

| commercial [kә'mә:ʃәl] | a. | 1) 贸易的,商业的 2) 营利的,以获利为目的的 |

| management ['mænidʒmәnt] | n. | 1) 管理,经营 2) 经营者,管理部门,资方 |

| group [gru:p] | n. | 1) 组,团体,群,批 2) [商]集团 |

| issue ['isju] | vt. | 1) 发行(新的一批) 2) 宣布,公布,发出 |

| bond [bɔnd] | n. | 1) 纽带,联系,关系,契合 2) 债券,公债 |

| normally ['nɔ:mәli] | ad. | 1) 通常;正常情况下 2) 正常地;平常地 |

| net [net] | a. | 1) 净的 2) 净得的,纯的 |

| asset ['æset] | n. | 1) [常用复数]资产,财产 2) 有价值的人(或事物) |

| yuan [ju:'ɑ:n] | n. | 元(中国货币单位) |

| total ['tәutl] | a. | 1) 总的,总计的,全体的,全部的 2) 完全的,彻底的,包括一切的 |

| wealth [welθ] | n. | 1) 财富,财产 2) 富裕,富足 |

| and [ænd] | conj. | 1) 和, 与, 同, 并 2) 然后,接着 |

| son [sʌn] | n. | 1) 儿子 2) 孩子 |

| reach [ri:tʃ] | vt. | 1) 达到,提升到,进入(新水平/阶段) 2) 到达, 抵达(某地,某点位) |

| rank [ræŋk] | vt. | 1) 把……分等级,属于(某等级) 2) 排列,使排成行 |

| ninth [nainθ] | num | 第九 |

| creation [kri:'eiʃәn] | n. | 1) 创造,创建 2) 创造物,(尤指)艺术作品,富于想象力的作品 |

| list [list] | n. | 1) 名单,目录,清单 2) (船)倾斜 |

以上是秒词邦为您整理编写的文章《王健林再度转让旗下资产,什么信号?》的全部内容。秒词邦是国内权威分题型分考点背诵中高考/四六级考研/专升本/出国单词的专业单词软件。扫描如下小程序码,进入秒词邦官方小程序获取更多英语相关资料! 【关键词:高考单词;高考英语;高中单词;高中英语;单词app;单词软件;记单词app;记单词软件;背单词软件;背单词app;英语单词;四六级单词;四六级英语;四六级单词app;四六级单词软件;考研单词app;考研单词软件;核心单词;高考冲刺复习;高考英语教材;高考英语真题;四六级真题;四六级试题;考研真题;考研英语单词;考研英语真题】