秒词邦

分题型分考点背单词 文

文 文

文

百年老字号张小泉(301055)的两名实控人张国标、张樟生,近期因为涉及借款逾期无法归还导致的纠纷,被法院列为被执行人,并被法院出具《限制消费令》,限制高消费。

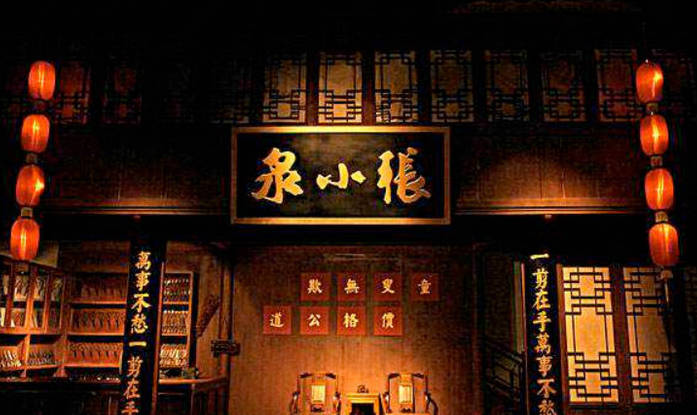

明朝万历年间,张思佳在徽州黟县开设一家剪刀店铺,号“张大隆”,后迁至杭州大井巷,1628年张小泉从其父张思佳手中接管店务,将“张大隆”改成自己的名字“张小泉”。

如今的张小泉已是我国刀剪头部品牌,市场占有率在1%左右。

张小泉现在的实控人,也是一个张氏家族。

1992年,杭州人张国标在上海浦东组建成立富春贸易公司,从混凝土搅拌站起家,之后进军港口、物流基地建设产业,参与开发了杭州崇贤港、嘉兴乍浦港的海运物流基地、建设了2.5万吨级乍浦港富春码头。目前,富春控股集团的产业横跨供应链、金融、医疗和智能制造等诸多行业。

2007年,富春控股以增资的方式取得了张小泉的实际控制权。2021年,张小泉登陆A股市场。以刀剪具为主,现在张小泉每年能销售超8个亿的生活五金用品。

曾还不出一个月短期借款

根据张小泉披露的公告,张国标、张樟生两名实控人涉及的均是借款合同纠纷的连带责任保证,借款方分别是富春控股集团的子公司、张小泉的大股东张小泉集团,以及上市公司的关联方、富春控股集团旗下的供应链公司。

这两笔逾期的借款,全部发生在陕西,总共合计近4.3亿元,但都是短期借款。查询官方公开信息可知,富春控股集团2022年以来,接连在陕西有多笔大额投资、合作以及项目开工。

张小泉连续两年的年报中并没有披露在陕西投资的相关信息,5月14日的业绩说明会上也没有正面回应投资者关于大股东担保和还贷款的问题,时代周报发去采访函也未获张小泉回应。

最近一次引发关注的实控人被法院限消案件,是张小泉5月10日披露的公告。

网营物联(杨凌)供应链有限公司(简称“网营物联杨凌公司”)因项目建设需要,2023年7月12日与长安银行股份有限公司杨凌示范区支行签订固定资产借款合同,金额3亿元。网营物联杨凌公司以其土地及在建工程提供抵押担保,杭州网营物联控股集团有限公司(简称“网营物联”)以其所持有的网营物联杨凌公司100%股权提供质押担保,同时富春控股集团、网营物联、张国标、张樟生等各方提供连带责任担保。

2024年5月8日,因网营物联杨凌公司未及时偿付本息,银行向陕西咸阳中院申请执行,借款方以及担保方都被列为被执行人。这意味着该笔借款期限不到一年。

张小泉在公告中称,网营物联、网营物联杨凌公司已对该笔债务提供足值抵押、质押物,并正在积极和债权方沟通和解方案,上市公司已督促实控人张国标、董事长张樟生及富春控股集团积极与执行申请人沟通协调处理相关事宜,寻求最佳解决方案。

但5月16日中国执行信息公开网显示,关于张国标、张樟生等的限消令依然挂网。

张小泉3月22日的公告,则披露实控人曾涉及另一笔借款纠纷。

2023年12月1日,张小泉集团向西安大明宫雁塔购物广场有限责任公司借款近1.279亿,由西安国信小额贷款有限公司受委托发放,借款期限是一个月。

但到期后张小泉集团无法归还,提供连带担保的张国标、张樟生等被法院限消。

时代周报查询中国执行信息公开网的最新信息,该笔借款张国标、张樟生的限消令已经撤网。

重点项目钱紧?

涉及3亿借款的当事人网营物联杨凌公司,背后是富春控股集团在陕西投资的项目。

公开信息显示,网营物联杨凌公司是网营物联的全资子公司。网营物联成立于2017年10月,注册资本50.5亿元,由富春控股集团和杭州奋华投资合伙企业(有限合伙)联合成立,后者是由浙商创投担任管理人的私募。据证券日报报道,杭州奋华投资合伙企业实为浙江省政府“凤凰行动”计划所设立的专项基金。

企业官网介绍称,网营物联依托富春控股30多年供应链运营经验及多方资源支持,在国内主要产业集聚区及城市商圈建设、运营智能供应链设施,致力于打造一个商流、物流、资金流和信息流集成化运营的全渠道供应链服务平台。法定代表人,董事长是张国标。

根据陕西当地政府网站的多篇文章显示,富春控股在2018年沪-陕合作项目推介会上签约重大产业项目网营物联(杨凌)供应链运营中心,是2019年陕西省、杨凌示范区、杨陵区三级政府重点建设项目,占地350亩,总投资额15亿元,一期8亿,二期7亿,建成后将是西北最大的综合物流园区,全面运营之后每年营业额将达到20亿元,带动就业约1500人,是网营物联布局陕西业务板块重要的一环。

2023年1月10日,二期工程正式开建。

根据网营物联杨凌公司的贷款日期以及固定资产抵押来看,是否是二期工程遇到资金困境?张小泉没有回应时代周报记者的询问。

值得注意的是,根据张小泉的公告以及法院执行文书的编号,这两次借款用的都是公证债权执行方式。

公证债权文书是指经公证赋予强制执行效力的债权文书,持有该种文书的债权人在对方不履行还款约定时,无需经过传统的诉讼程序,可直接申请强制执行。有法律界人士向时代周报记者表示,此种文书在签订时就已载明,债务人除了对有关给付内容无疑义之外,还包括在不履行义务或不完全履行义务时,债务人愿意接受依法强制执行的承诺。采取这种借款方式的特点是标的额巨大,用款需求迫切,但大多不能执行到位。

有金融机构人士向时代周报记者表示,这种方式每一笔贷款都要提前做公证以防出事,所以成本和客户体验度不好,一般很少做此类业务。

宏大的投资版图

张小泉的实控方富春控股集团,创建于1992年,总部位于上海市浦东新区,产业涉及供应链、智能制造、医疗康养、金融等领域,企业旗下拥有张小泉、杭加新材、网营物联、如意仓、运通网城、富春山居、浙江大学康复医院、公望健康、东方茂等10余个品牌。

据公开信息不完全统计,富春控股集团近几年来在陕西有大量投资及合作。

西安经济技术开发区官网2022年9月份发布文章,富春控股集团中央厨房供应链产业园,汽车零部件产业园两个项目2022年9月21日落户经开区。中央厨房供应链产业园项目总投资约12亿元,规划包括品牌中央厨房、多温区冷库、食材加工及分拣中心、产品展示中心、区域集中配送中心、办公楼配套等组成,以“中央厨房+智能冷链配送中心”为核心。

汽车零部件产业园项目位于经开区泾渭新城,总投资约10亿元,规划由汽车制造企业总部基地、汽车零部件制造中心、汽车供应链运营中心组成,依照经开区区域总体发展规划和产业转型发展的需要,围绕汽车、汽配产业,建设现代化、数字化、智能化汽车及零部件创新服务示范基地。

2023年2月16日,西安高新区与富春控股签署系列投资合作框架协议,双方将围绕产业发展、项目建设等内容展开深度合作。

2023年7月4日,富春控股集团与西安高科集团签约,围绕项目开发和产业发展签署项目意向合作协议。

据天眼查显示,富春控股以及张国标,均有相当数量的股权于2023年6月份出质于陕西当地的煤业公司和融资租赁公司,富春控股目前仍被列为3月份和5月份两笔借款纠纷的被执行人。

责任编辑:朱鹏英 UN603

新闻译文:

The two actual controllers of the century old brand Zhang Xiaoquan (301055), Zhang Guobiao and Zhang Zhangsheng, were recently listed as defendants by the court due to disputes caused by overdue repayment of loans. The court issued a "Restriction on Consumption Order" to restrict high consumption.

During the Wanli period of the Ming Dynasty, Zhang Sijia opened a scissor shop called "Zhang Dalong" in Yixian County, Huizhou. Later, he moved to Dajing Lane in Hangzhou. In 1628, Zhang Xiaoquan took over the shop from his father Zhang Sijia and changed "Zhang Dalong" to his own name "Zhang Xiaoquan".

Nowadays, Zhang Xiaoquan is a leading brand of knives and scissors in China, with a market share of about 1%.

The current actual controller of Zhang Xiaoquan is also a member of the Zhang family.

In 1992, Zhang Guobiao, a native of Hangzhou, established the Fuchun Trading Company in Pudong, Shanghai. He started with a concrete mixing plant and later entered the port and logistics base construction industry. He participated in the development of maritime logistics bases in Chongxian Port in Hangzhou and Zhapu Port in Jiaxing, and built the 25000 ton Fuchun Port in Zhapu Port. At present, Fuchun Holdings Group's industries span across many industries such as supply chain, finance, healthcare, and intelligent manufacturing.

In 2007, Fuchun Holdings acquired actual control of Zhang Xiaoquan through capital increase. In 2021, Zhang Xiaoquan landed on the A-share market. Mainly focusing on knives and scissors, Zhang Xiaoquan can now sell over 800 million yuan of daily hardware products annually.

I used to repay short-term loans for less than a month

According to the announcement disclosed by Zhang Xiaoquan, both Zhang Guobiao and Zhang Zhangsheng are involved in joint liability guarantees for loan contract disputes. The borrowers are subsidiaries of Fuchun Holdings Group, Zhang Xiaoquan Group, a major shareholder of Zhang Xiaoquan, as well as affiliated parties of the listed company and supply chain companies under Fuchun Holdings Group.

These two overdue loans all occurred in Shaanxi, totaling nearly 430 million yuan, but both were short-term loans. according to official public information, since 2022, Fuchun Holdings Group has made multiple large-scale investments, collaborations, and project commencement in Shaanxi.

Zhang Xiaoquan did not disclose any information about his investment in Shaanxi in his annual reports for two consecutive years, nor did he respond positively to investors' questions about major shareholder guarantees and loan repayments at the performance briefing on May 14th. Time Weekly also sent an interview letter but did not receive a response from Zhang Xiaoquan.

The latest case that attracted attention was the court's restriction on the disposal of the actual controller, which was disclosed by Zhang Xiaoquan on May 10th.

Internet of Things (Yangling) Supply Chain Co., Ltd. (referred to as "Internet of Things Yangling Company") signed a fixed asset loan contract with Chang'an Bank Co., Ltd. Yangling Demonstration Zone Branch on July 12, 2023, for a total amount of 300 million yuan, due to project construction needs. Wangying IoT Yangling Company provides mortgage guarantee with its land and construction in progress, Hangzhou Wangying IoT Holdings Group Co., Ltd. (referred to as "Wangying IoT") provides mortgage guarantee with 100% equity of Wangying IoT Yangling Company held by it, and Fuchun Holdings Group, Wangying IoT, Zhang Guobiao, Zhang Zhangsheng and other parties provide joint liability guarantee.

On May 8, 2024, due to the failure of Yangling Company of Internet of Things to repay principal and interest in a timely manner, the bank applied to the Shaanxi Xianyang Intermediate People's Court for enforcement, and both the borrower and guarantor were listed as executed persons. This means that the loan term is less than one year.

Zhang Xiaoquan stated in the announcement that NetEase of Things and NetEase of Things Yangling Company have provided sufficient collateral and collateral for the debt, and are actively communicating with the creditor for a settlement plan. The listed company has urged the actual controller Zhang Guobiao, chairman Zhang Zhangsheng, and Fuchun Holdings Group to actively communicate and coordinate with the executing applicant to handle relevant matters and seek the best solution.

However, on May 16th, the China Executive Information Disclosure Network showed that consumer restriction orders regarding Zhang Guobiao, Zhang Zhangsheng, and others are still hanging online.

Zhang Xiaoquan's announcement on March 22 disclosed that the actual controller was involved in another loan dispute.

On December 1, 2023, Zhang Xiaoquan Group borrowed nearly 127.9 million yuan from Xi'an Daming Palace Yanta Shopping Plaza Co., Ltd., entrusted by Xi'an Guoxin Small Loan Co., Ltd., with a loan term of one month.

But after the expiration, Zhang Xiaoquan Group was unable to return the loan, and Zhang Guobiao, Zhang Zhangsheng, and others who provided joint and several guarantees were restricted by the court.

According to the latest information from China Execution Information Disclosure Network, the consumption restriction orders of Zhang Guobiao and Zhang Zhangsheng for the loan have been withdrawn from the website.

Is there a tight budget for key projects?

The party involved in a 300 million loan, Yangling Company of IoT, is a project invested by Fuchun Holdings Group in Shaanxi.

According to public information, Yangling Company of Internet of Things is a wholly-owned subsidiary of Internet of Things. The Internet of Things was established in October 2017 with a registered capital of 5.05 billion yuan. It was jointly established by Fuchun Holdings Group and Hangzhou Fenhua Investment Partnership (Limited Partnership), which is a private equity managed by Zhejiang Venture Capital. According to Securities Daily, Hangzhou Fenhua Investment Partnership Enterprise is actually a special fund established by the Zhejiang Provincial Government's "Phoenix Action" plan.

According to the official website of the enterprise, NetEase of Things relies on Fuchun Holdings' more than 30 years of supply chain operation experience and multi-party resource support to build and operate intelligent supply chain facilities in major industrial clusters and urban commercial districts in China, committed to creating a multi-channel supply chain service platform for integrated operation of commercial flow, logistics, capital flow, and information flow. The legal representative and chairman are Zhang Guobiao.

According to multiple articles on the local government website in Shaanxi, Fuchun Holdings signed a major industrial project, the Yangling Internet of Things (IoT) Supply Chain Operation Center, at the 2018 Shanghai Shaanxi Cooperation Project Promotion Conference. It is a key construction project of the Shaanxi Province, Yangling Demonstration Zone, and Yangling district governments in 2019, covering an area of 350 acres, with a total investment of 1.5 billion yuan. The first phase is 800 million yuan, and the second phase is 700 million yuan. After completion, it will be the largest comprehensive logistics park in northwest China. After full operation, the annual revenue will reach 2 billion yuan, driving employment of about 1500 people, and is an important part of IoT's layout in Shaanxi's business sector.

On January 10, 2023, the second phase of the project officially began construction.

Based on the loan date and fixed asset mortgage of Yangling Company, is it due to financial difficulties encountered in the second phase of the project? Zhang Xiaoquan did not respond to inquiries from Time Weekly reporters.

It is worth noting that according to Zhang Xiaoquan's announcement and the court's execution document number, both loans were executed using a notarized debt enforcement method.

A notarized debt document refers to a debt document that has been notarized and given compulsory enforcement effect. Creditors holding this type of document can directly apply for compulsory enforcement without going through traditional litigation procedures when the other party fails to fulfill the repayment agreement. Legal professionals have told Time Weekly reporters that such documents have already stated at the time of signing that the debtor not only has no doubts about the relevant payment content, but also includes a commitment to accept compulsory enforcement in the event of non performance or incomplete performance of obligations. The characteristic of adopting this borrowing method is that the target amount is huge and the demand for funds is urgent, but most of them cannot be fully executed.

A financial institution representative told Time Weekly reporters that this method requires each loan to be notarized in advance to prevent accidents, so the cost and customer experience are not good, and such business is generally rarely done.

A grand investment landscape

Fuchun Holdings Group, the actual controlling shareholder of Zhang Xiaoquan, was founded in 1992 and is headquartered in Pudong New Area, Shanghai. Its industries involve supply chain, intelligent manufacturing, medical and health care, finance, and other fields. The company owns more than 10 brands, including Zhang Xiaoquan, Hangjia New Materials, Internet of Things, Ruyi Warehouse, Yuntong Online City, Fuchun Shanju, Zhejiang University Rehabilitation Hospital, Gongwang Health, and Dongfang Mao.

According to incomplete public information statistics, Fuchun Holdings Group has made significant investments and collaborations in Shaanxi in recent years.

The official website of Xi'an economic and Technological Development Zone released an article in September 2022, stating that two projects, the central Kitchen Supply Chain Industrial Park and the Automotive Parts Industrial Park of Fuchun Holdings Group, were settled in the Economic and Technological Development Zone on September 21, 2022. The total investment of the Central Kitchen Supply Chain Industrial Park project is about 1.2 billion yuan. The plan includes a branded central kitchen, multi temperature cold storage, ingredient processing and sorting center, product display center, regional centralized distribution center, office building supporting facilities, etc., with "Central Kitchen+Intelligent Cold Chain Distribution Center" as the core.

The Automotive Parts industry Park project is located in Jingwei New City, Economic Development Zone, with a total investment of about 1 billion yuan. It is planned to be composed of the headquarters base of automotive manufacturing enterprises, the automotive parts manufacturing center, and the automotive supply chain operation center. In accordance with the overall development plan of the Economic Development Zone and the needs of industrial transformation and development, it will focus on the automotive and auto parts industry to build a modern, digital, and intelligent automotive and parts innovation service demonstration base.

On February 16, 2023, Xi'an High tech Zone and Fuchun Holdings signed a series of investment cooperation framework agreements, and the two sides will engage in in-depth cooperation around industrial development, project construction, and other content.

On July 4, 2023, Fuchun Holdings Group signed a project intention cooperation agreement with Xi'an High tech Group regarding project development and industrial development.

According to Tianyancha, both Fuchun Holdings and Zhang Guobiao have a considerable amount of equity pledged to local coal and finance leasing companies in Shaanxi in June 2023. Fuchun Holdings is still listed as the debtor in two loan disputes in March and May.

Editor in charge: Zhu Pengying UN603

名实 name and reality ; concept and entity

借款逾期 Loan overdue ; overdue debt

被执行人 If the person

限制消费 limited consumption

高消费 high consumption ; high level of consumption ; high-value consumption

黟县 Yi county ; Yixian county

大隆 Dalong ; brodifacoum ; talon

自己的 own ; self ; ain ; oneʼs

市场占有率 market share

贸易公司 trade company ; trading company ; trading corporation ; trading firm

句子成分分析:

The Automotive Parts Industry Park project is located in Jingwei New City, Economic Development Zone, [with a

total investment (of about 1 billion yuan)].

句子语法结构详解:

* is 为系动词作谓语,采用一般现在时。

* located 为形容词作表语。

* the 为定冠词。a 为不定冠词。

句子相关词汇解释:

Vocabulary:

| automotive [,ɔ:tәu'mәutiv] | a. | 汽车的;机动车的 |

| part [pɑ:t] | n. | 1) 部分 2) 部件,零件 3) 角色,台词 |

| industry ['indәstri] | n. | 1) 工业,生产制造 2) 行业 |

| park [pɑ:k] | n. | 1) 公园 2) 专用区,园区 |

| project ['prɔdʒekt] | n. | 1) (生产或研究等)项目,方案,工程 2) 方案,计划 |

| located | a. | 位于,座落在 |

| new [nju:] | a. | 1) 新的,刚出现的,新近推出的 2) (the new)新东西,新事物 |

| city ['siti] | n. | 1) 城市; 都市; 市 2) 全市市民 |

| economic [,i:kә'nɔmik] | a. | 1) 经济的,经济上的,经济学的 2) (工序、业务或活动)有利可图的,可赚钱的,合算的 |

| development [di'velәpmәnt] | n. | 1) 成长,发展,壮大 2) 研制,开发 |

| zone [zәun] | n. | 1) 地带,地区 2) 分区,区域 |

| total ['tәutl] | a. | 1) 总的,总计的,全体的,全部的 2) 完全的,彻底的,包括一切的 |

| investment [in'vestmәnt] | n. | 1) 投资 2) 投资额,投资物 |

| about [ә'baut] | ad. | 1) 大约, 差不多 2) 将近, 几乎 |

| yuan [ju:'ɑ:n] | n. | 元(中国货币单位) |

句子成分分析:

[According to Tianyancha], both Fuchun Holdings and Zhang Guobiao have a considerable amount (of equity

pledged to local coal and finance leasing companies [in Shaanxi] [in June 2023]).

句子语法结构详解:

* have 为谓语,采用一般现在时。

* pledged 为过去分词,作后置定语。

* leasing 为现在分词,作后置定语。

* a 为不定冠词。

句子相关词汇解释:

Phrase:

| according to | 根据,据(某人)所述 |

Vocabulary:

| both [bәuθ] | a. | 两个...(都) |

| holding ['hәuldiŋ] | n. | 1) 股份 2) 私有财产;(博物馆、图书馆等的)馆藏 |

| and [ænd] | conj. | 1) 和, 与, 同, 并 2) 然后,接着 |

| have [hæv] | vt. | 1) 有,持有 2) 吃,喝, 抽(烟) 3) 患病,出现(某症状) |

| considerable [kәn'sidәrәbl] | a. | 相当多(或大、重要等)的 |

| amount [ә'maunt] | n. | 1) 数量,数额(尤与不可数名词连用) 2) 金额 |

| equity ['ekwiti] | n. | 1) (公司的)股本,资产净值 2) (equities)(公司的)普通股 |

| pledge [pledʒ] | vt. | 1) 使保证,使发誓 2) 保证给予(或做),正式承诺 |

| local ['lәukәl] | a. | 1) 地方的,当地的,本地的 2) (身体)局部的 |

| coal [kәul] | n. | 煤,煤块 |

| finance [fai'næns] | n. | 1) 金融,财务 2) 资金 |

| lease [li:s] | vt. | 租用,租借,出租(尤指房地产或设备) |

| company ['kʌmpәni] | n. | 1) 公司 2) 陪伴 |

| Shaanxi | n. | [中国省市] 陕西 |

以上是秒词邦为您整理编写的文章《“剪刀之王”背后资本大佬的危局:已被限制高消费 ——秒词邦背单词app》的全部内容。秒词邦是国内权威分题型分考点背诵中高考/四六级考研/专升本/出国单词的专业单词软件。扫描如下小程序码,进入秒词邦官方小程序获取更多英语相关资料! 【关键词:高考单词;高考英语;高中单词;高中英语;单词app;单词软件;记单词app;记单词软件;背单词软件;背单词app;英语单词;四六级单词;四六级英语;四六级单词app;四六级单词软件;考研单词app;考研单词软件;核心单词;高考冲刺复习;高考英语教材;高考英语真题;四六级真题;四六级试题;考研真题;考研英语单词;考研英语真题】